We’re told America is the land of opportunity. If you work hard, play by the rules, and pay your fair share, you’ll get ahead. But the reality is, that system rewards wealth over work, punishes the middle class, and turns a blind eye to abusive oversight by those at the top; not to mention those duly elected to serve the people, serving themselves the cream of the crop. If one truly wants to make America great, not just in catchphrases, but in substance, we need to start by calling out the hypocrisy sown into how we fund the country.

The Illusion of Fairness: On the surface, the tax system looks almost fair; especially if you can’t read. Rich people pay higher rates, right? Not even close! While federal income tax rates rise with income, other taxes, like Social Security and sales taxes, hit working people the hardest. A White House report and ProPublica data: The 400 richest Americans paid a federal income tax rate of 8.2%. The average American pays around 13-15% in federal taxes, with total tax rates (including payroll and other taxes), sometimes over 20%; more in California. A soldier or truck driver pays a larger share of their income in payroll taxes than any CEO whose income comes mostly from investments.

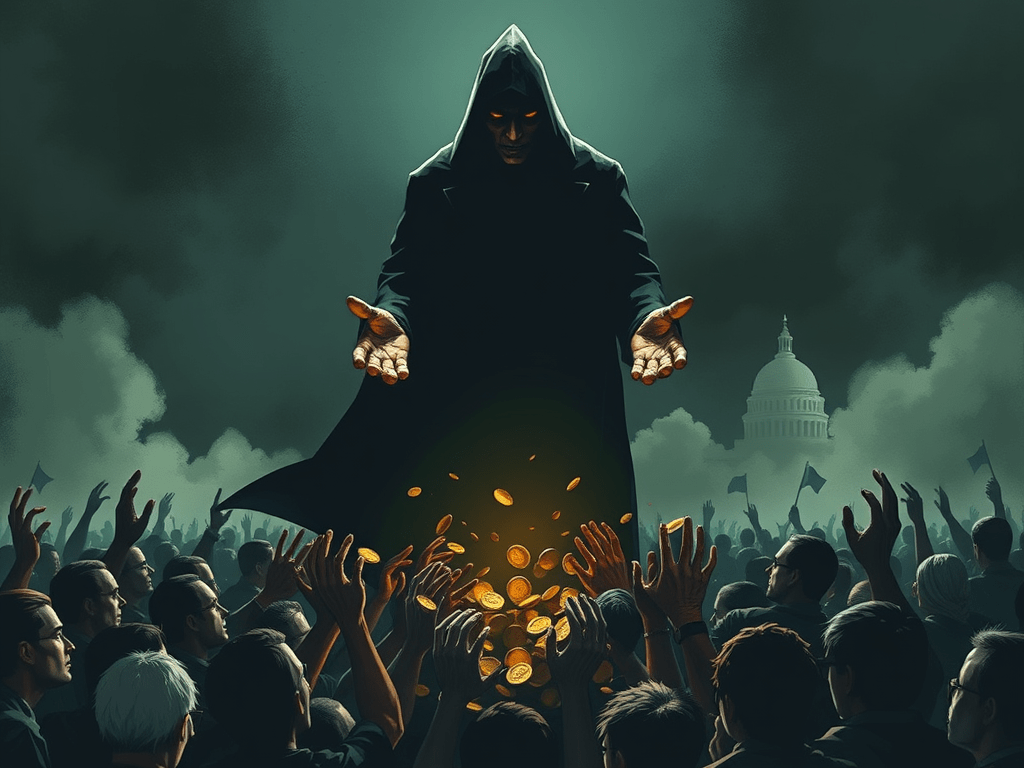

Wealth Buys a Different Set of Rules: Ordinary Americans can’t afford teams of accountants and tax lawyers. But billionaires can, and do. They shift money into shell companies, hide profits overseas, and use complex tricks to dodge taxes. In some years, the richest people in the country pay little or nothing. Meanwhile, the rest of us cover the cost of roads, schools, and public safety. We actually pay for their comforts!

Rewarding Wealth Over Work: Why do we tax work more than wealth? Wages are taxed up to 37%, up to 56%, if you work the markets in California. Though long–term capital gains are taxed at just 15-20%. If you build a small business or punch a clock, you’re taxed more heavily than someone who makes millions from stock portfolios. That’s not capitalism. It’s rigging the game.

Big Corporations, Tiny Tax Bills: You’d think profitable companies would chip in to keep America running. Yet giants like Amazon, Nike, Netflix, Apple, and Tesla have paid little or no federal taxes some years. They use loopholes and offshore tax havens to shrink their bills, even while raking in billions in tax rebates. This isn’t free enterprise. It’s corporate welfare. Yes, I said it. They have zero problems talking down to those not in the 1%; all while taking most of our money. So let’s try to stop being in aw of those leeches that are taking money from you, yours, and ours.

Real Patriotism Means Fixing What’s Broken: If we want to restore faith in the American Dream (the American Nightmare for many), we need a tax system that rewards effort, not exploitation. That means closing the loopholes, taxing with equality to actual wealth, and enforcing the law equally. Making America great shouldn’t be about slogans, but about equality, justice, and a government that works for everyone; and not for themselves like a club of pimps they have been and are still.

The Recipe: Speaking Truth to Power, calling out injustice, corruption, or inequality, even when it’s uncomfortable – is patriotic. Working for the Common Good, real patriots care about all their fellow citizens. Fixing Founding Ideals, the U.S. loved to claim principles like liberty, justice, and equality; however, the U.S. never implemented the ideals in practice. Taking Responsibility, doing your fair share to help make it great, volunteering, paying fair taxes, and holding the government accountable are all acts of patriotism. Loving with Eyes Open, a patriot sees a country’s flaws and works to fix them, rather than pretending they don’t exist. Loyalty doesn’t mean silence; it means action with purpose.

As Frederick Douglass said: “True patriotism is loving your country enough to criticize it.“

It’s appreciated if you add a like, subscribe, and share this post with others. Then, join the conversation. There’s plenty more where this came from, so check out some previous conversations.

Keep scrolling down for more of the conversation

Leave a reply to Patrick Hardeman Cancel reply